March 2, 2022 – Our reaction to the Russian invasion of Ukraine is one of compassion for all those directly impacted, and our thoughts are with you as these unsettling events unfold in front of us.

A Quarter in Review: Fourth Quarter 2021

2021 was a positive year by many economic measures and this showed up in strong GDP growth. Despite the persistence of the pandemic and higher inflation in 2021, the economy showed strength in spending habits and healthy consumer balance sheets, housing prices, job growth, wage increases, manufacturing and services activity, government investment, and corporate profits. The unemployment rate dropped to 3.9% by year end, just half a percent higher than it was pre-pandemic when the economy was humming along.

A Quarter in Review: Third Quarter 2021

Global economic growth has been strong with economists forecasting ~6% growth in 2021. In the U.S., GDP growth is expected to be around 5% for the third quarter (it was 6.3% in Q1 and 6.7% in Q2). While the rate of growth is expected to slow this quarter relative to earlier in the year, we remain in a much stronger growth environment than we’ve experienced in the past several years; about double to put it in perspective. Along with this growth, long-term interest rates rose, likely helped by the expected Fed asset purchase tapering later this year and continued inflation concerns.

A Quarter in Review: Second Quarter 2021

It was a strong quarter for global growth and global markets. Advances were driven by expanding vaccinations, relaxation of shutdown measures and the flood of economic activity from reopening coupled with pent-up demand and continued accommodative fiscal and monetary policy. GDP growth is expanding rapidly, both domestically and overseas. Global corporate earnings and forward estimates generally remained upbeat amid improving economic data. In the U.S., the unemployment rate remained a concern, edging higher and remaining well above its pre-pandemic level. Conditions should therefore remain accommodative.

A Quarter in Review: First Quarter 2021

What a difference a year makes! While it may seem much longer since we have been under global pandemic-induced “house arrest”, the end of the first quarter of 2020 had us all feeling a bit worse, at least from a capital markets perspective, than the end of the first quarter of 2021. A year ago, we were amid one of the swiftest market declines on record. Today, we sit near all-time highs. While that comes with its own risks, it certainly feels much better.

A Quarter in Review: Fourth Quarter 2020

The year 2020 proved to be one of the most tumultuous in modern history, marked by a number of developments that were historically unprecedented and unpredictable. It also demonstrated the resilience of people, democratic institutions, and global financial markets. Despite the extraordinary events of the first few weeks of 2021, and the likelihood we will have a very difficult winter, we are optimistic about 2021. Multiple vaccines have been approved and while off to a sluggish start, there is reason to believe distribution will improve rapidly and the pandemic will finally draw to end late this year. That is not to say there are not uncertainties around the pace of the recovery, ongoing political uncertainty, and millions of people without employment opportunities. After two very strong years, we caution clients to expect more muted returns in the near future.

A Quarter in Review: Third Quarter 2020

The global capital markets have shown surprising resilience in the face of a global pandemic, rising political tensions – both domestic and foreign, and ended the 3rd quarter of 2020 in much the same place where they started the year. While this may be surprising to many, we remind ourselves the markets do not only consider the current news but look forward – oftentimes by many years – to a post-COVID19 world. Will workers go back to the office five days a week? We don’t think so. Will consumers go back to dining out more frequently? Absolutely, but when will that be? In other words, the winners and losers of the Pandemic economy are driving the current market rise, but who emerges as the eventual winners is not yet clear. This hardens our conviction that maintaining global diversification and rebalancing remains very important in your portfolios.

Election 2020 – A perspective on the markets

October 3, 2020 – We are a few weeks out from the U.S. Election, where we will once again cast our vote in a choice between two different political and philosophical paths that lead to two different visions of the future. This time, however, the election feels more fraught and more like an amplifier than at any time in recent history.

A Quarter in Review: Second Quarter 2020

Divergence in global policy around the handling of the Coronavirus has become the central theme around investing, economics, and geopolitics in 2020. While we don’t know what grade the U.S. will receive in its response, we certainly know it will not be top of the class on the health policy side as medical experts are unfortunately sidelined to politics. However, massive and early fiscal and monetary responses have staved off the worst effects on the economy for now. With all the uncertainty in the direction of the economy and capital markets, discipline around maintaining global diversification and rebalancing remains very important in your portfolios.

What Is Up With The Stock Market?

June 24, 2020 - As of writing this email, the stock market has almost gained back what it lost since the beginning of 2020, leaving many scratching their heads about what is driving the market and what could derail this recovery? You can find bulls and bears with equally compelling arguments on both sides, which might leave you with a sense that the valuation of the stock market is nothing more than a guessing game.

Waypoint Wealth Partners – Where We Stand

"Our lives begin to end the day we become silent about things that matter." - Dr. Martin Luther King, Jr.

In the last few weeks following the tragic death of George Floyd, we have been thinking and reflecting about what this moment means to us, both as individuals and as leaders of our firm and in our profession. We feel outraged by what we saw on that video and saddened that we have seen this far too many times. Reality has shone a blazing light on the structural inequalities that are ingrained in our society.

How Can You Help During the Coronavirus Pandemic? #GivingTuesdayNow

May 5, 2020 The coronavirus pandemic has upended all our lives, but for many it also threatens their livelihood even without the worry of contracting the virus itself. Broad segments of our local communities are struggling with the most basic of needs, beyond those of employment and health. For these community members, food, safety, and shelter are a daily struggle. Even before the coronavirus pandemic and the economic recession these issues were becoming visually evident across major California cities with encampments and tent cities growing in recent years. There is reason to expect the number of unsheltered members of our communities will swell in the coming months. The call from non-profit organizations who help against these struggles is at a fever pitch, while many of their tools for fundraising – galas, fun runs, and open houses – have been canceled or postponed indefinitely.

A Quarter Unlike Any Other

On January 8th, the New York Times published a news story in their Global Health section, headlined “China Identifies New Virus Causing Pneumonialike illness” with a lead paragraph saying, “There is no evidence that the new virus is readily spread by humans.” That was three days before the first death, one month before the stock market high, and both a short and very long three months ago.

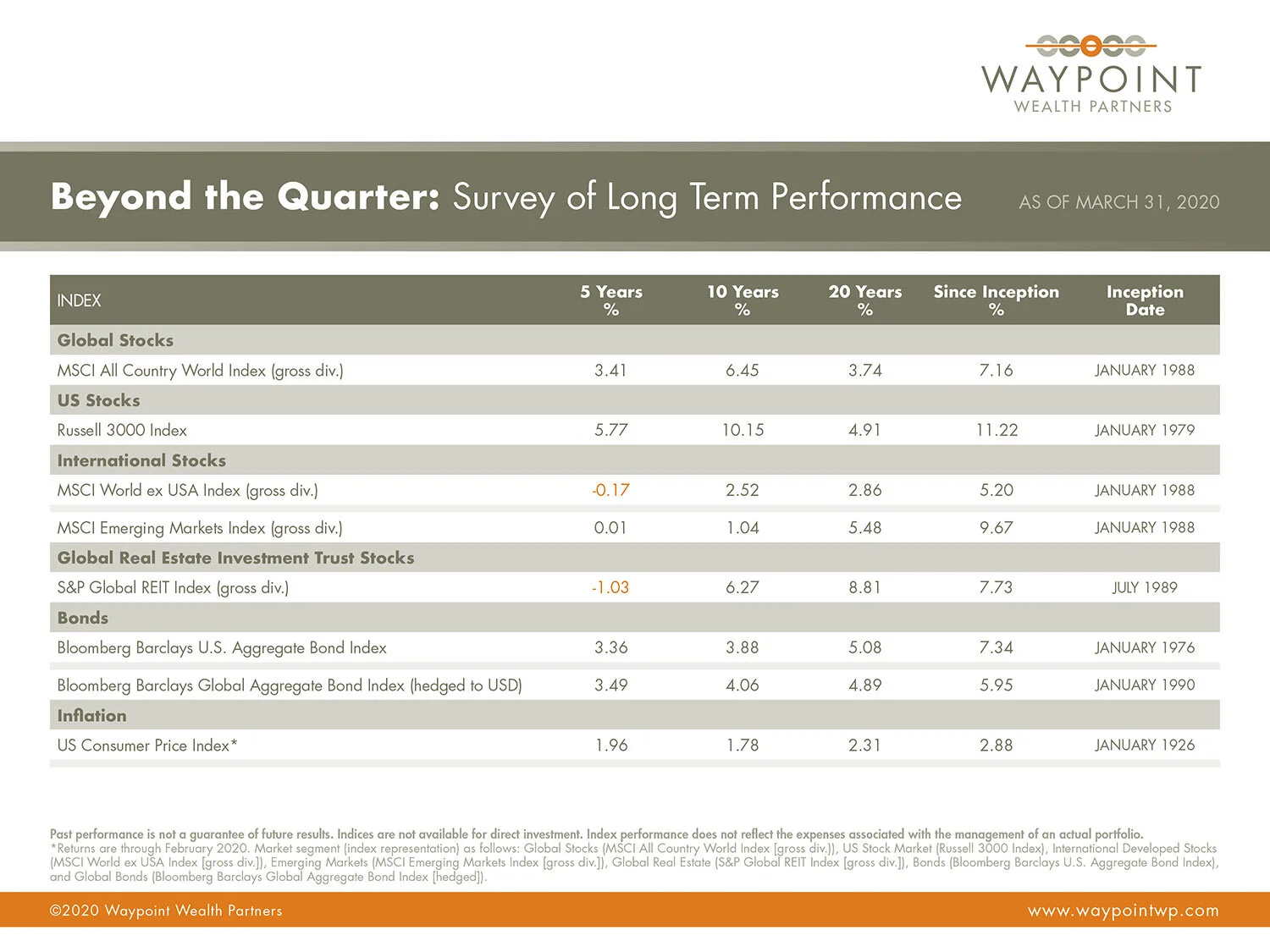

A Quarter in Review: First Quarter 2020

Mitigation has become the central theme around investing, economics, and geopolitics in 2020. Governments have had to quickly come up with plans, both good and bad, to mitigate the spread and impact of SARS-Covid-2, businesses have had to innovate or shutter to comply with regulations, and everyone has had to come up with their own plans for how to go out into the world while mitigating their own potential risk of exposure. At this point, the economy has almost certainly entered a recession, something that occurs on average every 4 to 5 years. As a result, Global Central banks have quickly pivoted to injecting as much cash and liquidity into their banking systems as they can, legislators have worked on rushing through relief packets for businesses and people affected by the shutdowns. With all of this uncertainty, discipline around diversification and rebalancing remains very important in your portfolios.

$2 Trillion Stimulus & the Passage of the CARES Act – What it Means for Small Business Owners

Perspective on the markets

MARCH 20, 2020 As we all conclude our first week of sheltering-in-place here in the San Francisco Bay Area, and now mandated for all of California, we want you to know that Waypoint’s disaster response plan has allowed us to be fully functional in all areas of operations, trading, and client service. We are available to talk with you, answer your questions and listen to what is on your mind. We have all necessary information at our fingertips to help put this challenging and unfolding experience in perspective for you. Please do not hesitate to reach out to us at any time.

Thoughts as we head into the week

MARCH 17, 2020 We are expecting significant market volatility to continue this week as more countries and our communities take unprecedented measures to contain the spread of Covid-19. The name of the game right now is slowing the spread of this disease so we don’t overwhelm our medical system and it is requiring us all to radically shift our daily routines. This is hard, to be sure, and it’s taking a toll on our local economies and the global economy, but we will get through this! It is important that we all remember that right now. We don’t know exactly when or how, but if we focus on what is in our control right now and do everything we can to support the effort, we will be successful. If there is ever a moment to remind us of our common humanity, now is the time.

Coronavirus Update

MARCH 9, 2020 It has been a trying two weeks since we last wrote to you. Not only for the markets, but collectively as we each seek to keep up with the news about the coronavirus and its impact on our daily lives. While our first concern in both calm or volatile markets is for your financial health, we are also concerned with your physical health and wellbeing. We hope each of you and those close to you are healthy and remain so.

Our Perspective on the Impact of the Novel Coronavirus on Client Portfolios

FEBRUARY 24, 2020 We wrote this article in consideration of recent news and the recent drop in stock markets, notably today’s 3.4% sharp drop. First, we want to acknowledge our prevailing view remains that the global economy remains intact, with the most likely outcome being modest growth for 2020. Including today’s stock market decline, the S&P 500 is back to beginning of 2020 levels with highly valued tech stocks bearing the brunt of the decline. However, we would be remiss not to acknowledge the growing risk to the economy from the novel coronavirus, Covid-19.

Be mindful of the news

If you look back at what was happening at the advent of the 2010’s, the global financial system had been on a shaky roller coaster over the previous three years and global central bank and fiscal policies were just starting to take hold (remember “TARP” AKA the bank bailout?). The global stock market was 10 months into a rebound but had a long way to go to recover its previous highs. The U.S. stock market itself was closing out the “lost decade,” where the S&P 500 Index had its worst decade on record, losing roughly 10% of its value over the span of January 2000 to December 2009.