Markets Update: A Quarter in Review

ECONOMY

2021 was a positive year by many economic measures and this showed up in strong GDP growth. Despite the persistence of the pandemic and higher inflation in 2021, the economy showed strength in spending habits and healthy consumer balance sheets, housing prices, job growth, wage increases, manufacturing and services activity, government investment, and corporate profits. The unemployment rate dropped to 3.9% by year end, just half a percent higher than it was pre-pandemic when the economy was humming along.

The positive environment was overshadowed by inflation, the show stealer in terms of news headlines and an area of concern for most investors. It ended the year up over 6%, and we all experienced it in varying degrees depending on the goods and services we consumed. The tight jobs market and higher inflation has led to a shift in economic policy expectations.

In our last quarterly review, we wrote of concern about the Delta variant. This quarter, a much more contagious though seemingly less severe Omicron variant clouds the economic outlook. While the impact won’t be quantified until we get more data over the next several months, we saw it contributing to canceled flights over the holidays, delays in receiving goods, and general worker shortages across the public and private sectors of the economy. Despite this, a robust and supportive global economic growth environment is expected to continue throughout 2022, absent any exogenous shocks.

Here in the U.S. though, conditions will be less accommodative with Federal Reserve policy and government spending normalizing from emergency levels. Coupled with a contentious political environment and a mid-term election year, we should prepare for turbulence.

STOCKS

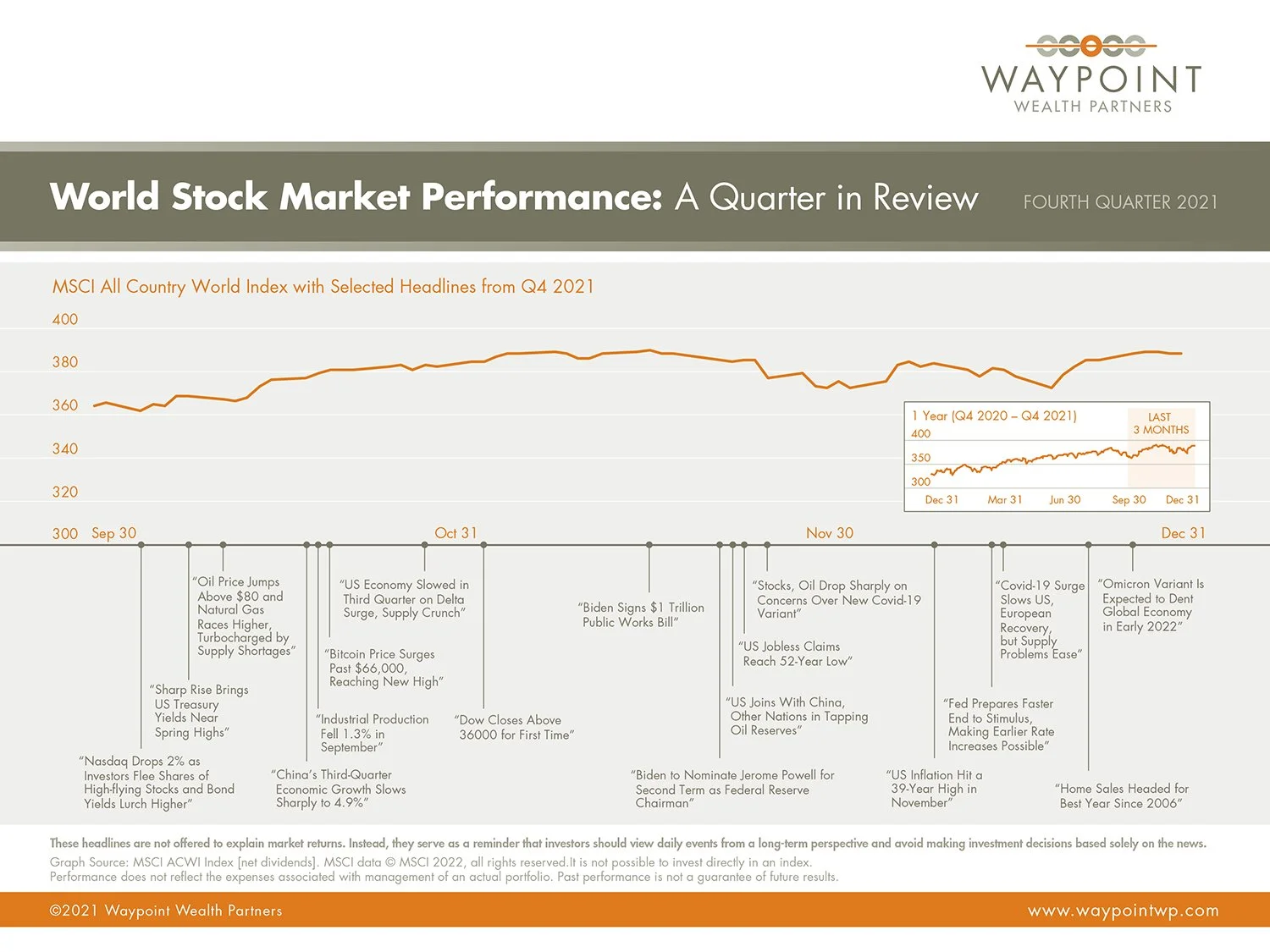

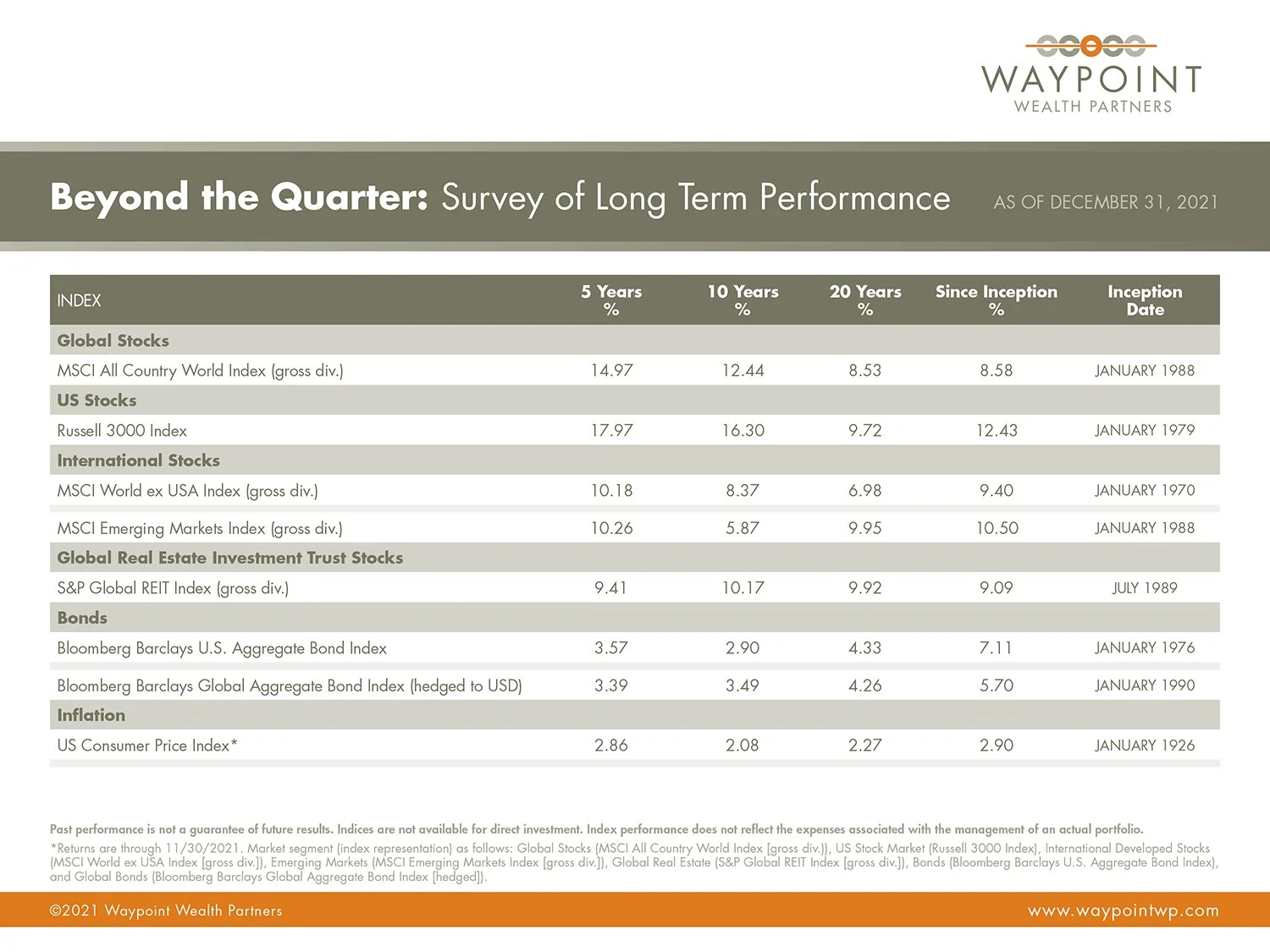

The silver lining is that a strong economic environment helped drive record corporate profits, and therefore, stock prices, well in excess of inflation. Global stocks, measured by the MSCI All-Country World Index (ACWI), were up 18.5% for the year.

U.S. stocks (Russell 3000), which make up more than half of the global index now, were up 9.3% in Q4 and 25.7% for the full year. To put things in perspective, the “worst” performing sector in the S&P 500, utilities, was up 18% for the year.

International developed stocks (MSCI Developed ex-US) were up 3.1% for the quarter and 12.6% for the year. Europe, especially the U.K. and France, and Japan were solid contributors.

Emerging markets stocks (MSCI EM) were the outlier with a 1.3% loss during the quarter and a 2.5% loss for the year. China, which accounts for more than one third of the EM index but only ~4% of global stocks, was the biggest detractor with a negative 21% return. Slowing growth from policy changes and leverage concerns in the property sector were the main drivers.

We remain cautious in our overall equity positioning, seeking to take less risk in expensive areas and more risk in cheaper regions and companies.

BONDS

The broad taxable investment grade bond index (U.S. Agg) was essentially flat for the quarter, up 0.01%, while it was down 1.5% overall in 2021. Global bonds ex-US were up 0.07% for the quarter, though down 1.4% for the full year.

Municipals, with improving credit profiles and surging investor demand in anticipation of higher tax rates, were up 0.7% in Q4 and returned 1.5% in 2021.

In this environment of low and rising interest rates and higher prices, we maintain a higher-quality and shorter duration fixed income stance to weather potential downturns. These could occur as a result of geopolictical shocks, herd selling, policy error, or any number of known or unknown risks that could cause a correction, bear market, or economic recession. Fixed income is our portfolio’s protection and ballast.

REAL ESTATE

Global real estate (S&P Global Real Estate) led the asset class pack, returning 12.4% in Q4 and 31.4% in 2021. In general, strong cash flow, healthy balance sheets, access to capital, ample liquidity, attractive yield relative to fixed income, inflation, and potentially higher corporate tax rates, all contributed to the positive performance over the year, as did our diversification across geographies and real estate sectors.

Rising interest rates, the ending of eviction moratoriums, and new virus variants could make 2022 a more challenging environment for real estate.

——

Quarterly Article: All-Time-High Anxiety

Investors are often conflicted about record-high stock prices. They are pleased to see their existing equity holdings gain in value but apprehensive that higher prices somehow foreshadow a dramatic downturn in the future. And they may be reluctant to make new purchases since the traditional “buy low, sell high” mantra suggests committing funds to stocks at an all-time high is a surefire recipe for disappointment.

Financial journalists periodically stoke investors’ record-high anxiety by suggesting the laws of physics apply to financial markets—that what goes up must come down. “Stocks Head Back to Earth,” read a headline in the Wall Street Journal in 2012.1 “Weird Science: Wall Street Repeals Law of Gravity,” Barron’s put it in 2017.2 And a Los Angeles Times reporter had a similar take last year, noting that low interest rates have “helped stock and bond markets defy gravity.”3

Those who find such observations alarming will likely shy away from purchasing stocks at record highs. But shares are not heavy objects kept aloft through strenuous effort. They are perpetual claim tickets on companies’ earnings and dividends. Thousands of business managers go to work every day seeking projects that appear to offer profitable returns on capital while providing goods and services people desire. Although some new ideas and the firms behind them end in failure, history offers abundant evidence that investors around the world can be rewarded for the capital they provide.

Whether at a new high or a new low, today’s share price reflects investors’ collective judgment of what tomorrow’s earnings and dividends are likely to be—and those of all the tomorrows to come. And every day, stocks must be priced to deliver a positive expected return for the buyer. Otherwise, no trade would take place. It’s difficult to imagine a scenario where investors freely invest in stocks with the expectation of

losing money.

Investors should treat record high prices with neither excitement nor alarm, but rather indifference. If stocks have a positive expected return, reaching record highs with some frequency is exactly the outcome we would expect. Using month-end data over the 94-year period ending in 2020, the S&P 500 Index produced a new high in ending wealth in more than 30% of those monthly observations. Moreover, purchasing shares at all-time records has, on average, generated similar returns over subsequent one-, three-, and five-year periods to those of a strategy that purchases stocks following a sharp decline, as Exhibit 1 shows.

Humans are conditioned to think that after the rise must come the fall, tempting us to fiddle with our portfolios. But the data suggest such signals only exist in our imagination and that our efforts to improve results will just as likely penalize them.

Investors should take comfort knowing that share prices are not fighting the forces of gravity when they move higher and have confidence that record highs only tell us the system is working just as we would expect—nothing more.

——

1. Jonathan Cheng and Christian Berthelsen, “Stocks Head Back to Earth,” Wall Street Journal, February 11, 2012.

2. Kopin Tan, “Weird Science: Wall Street Repeals Law of Gravity,” Barron’s, August 7, 2017.

3. Russ Mitchell, “Tesla’s Insane Stock Price Makes Sense in a Market Gone Mad,” Los Angeles Times, July 22, 2020.

——