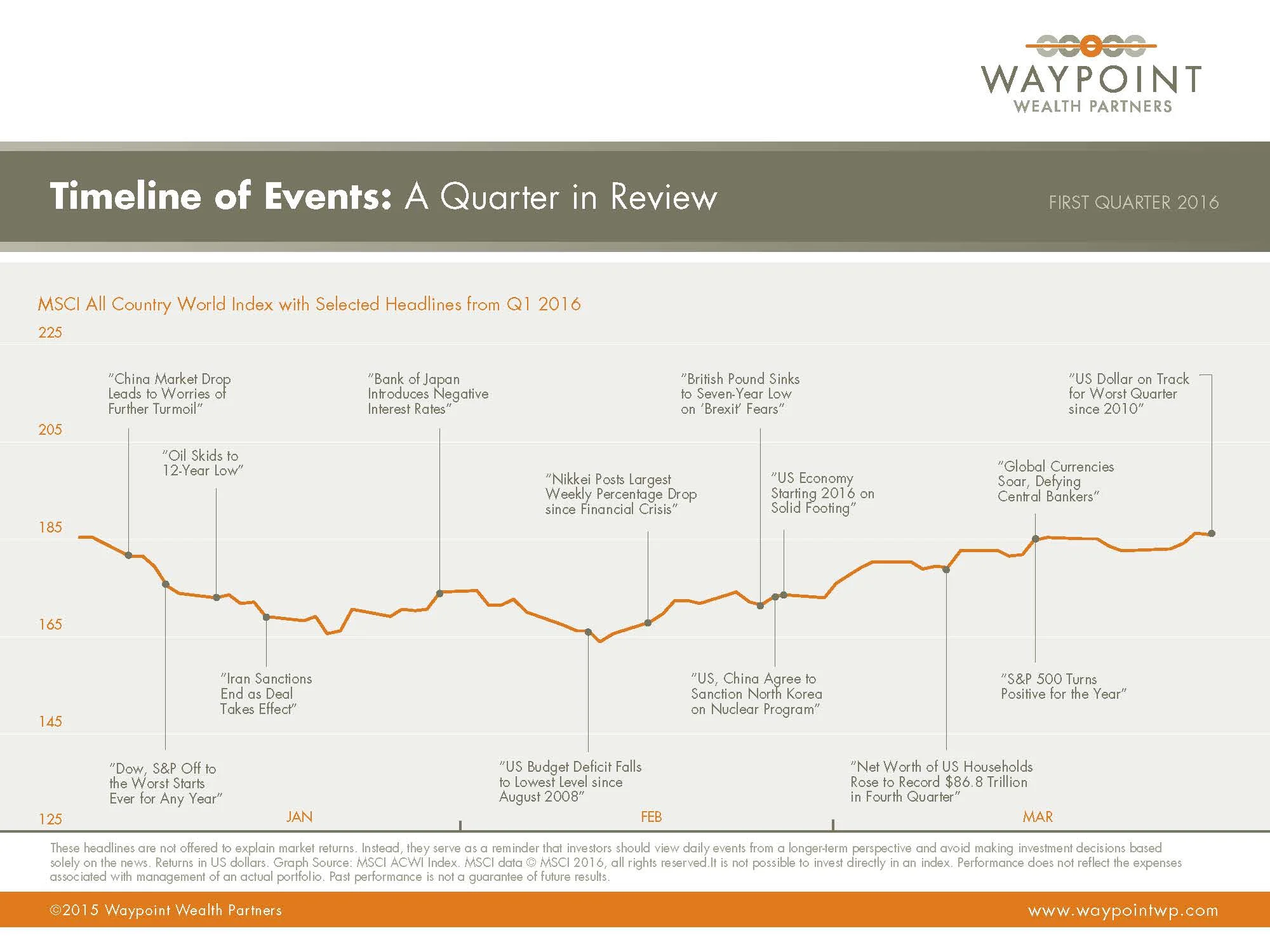

If you are just now looking at market returns for the first quarter you would be forgiven for thinking that the markets experienced a relatively boring three months. Developed markets finished flat, emerging markets were finally positive, real estate bounced back from a weak 2015 and bond returns were in the low single digits. However, a lot can happen in three months and what actually transpired was far from dull. January delivered one of the worst starts to a year the S&P 500 index has ever experienced, global recession concerns spiked, oil prices fluctuated wildly and the Chinese economy continued to produce mixed signals. Selling pressure continued through the first week of February before cooler heads prevailed and the second half of the quarter topped off a whirlwind of action with a significant recovery.

BONDS

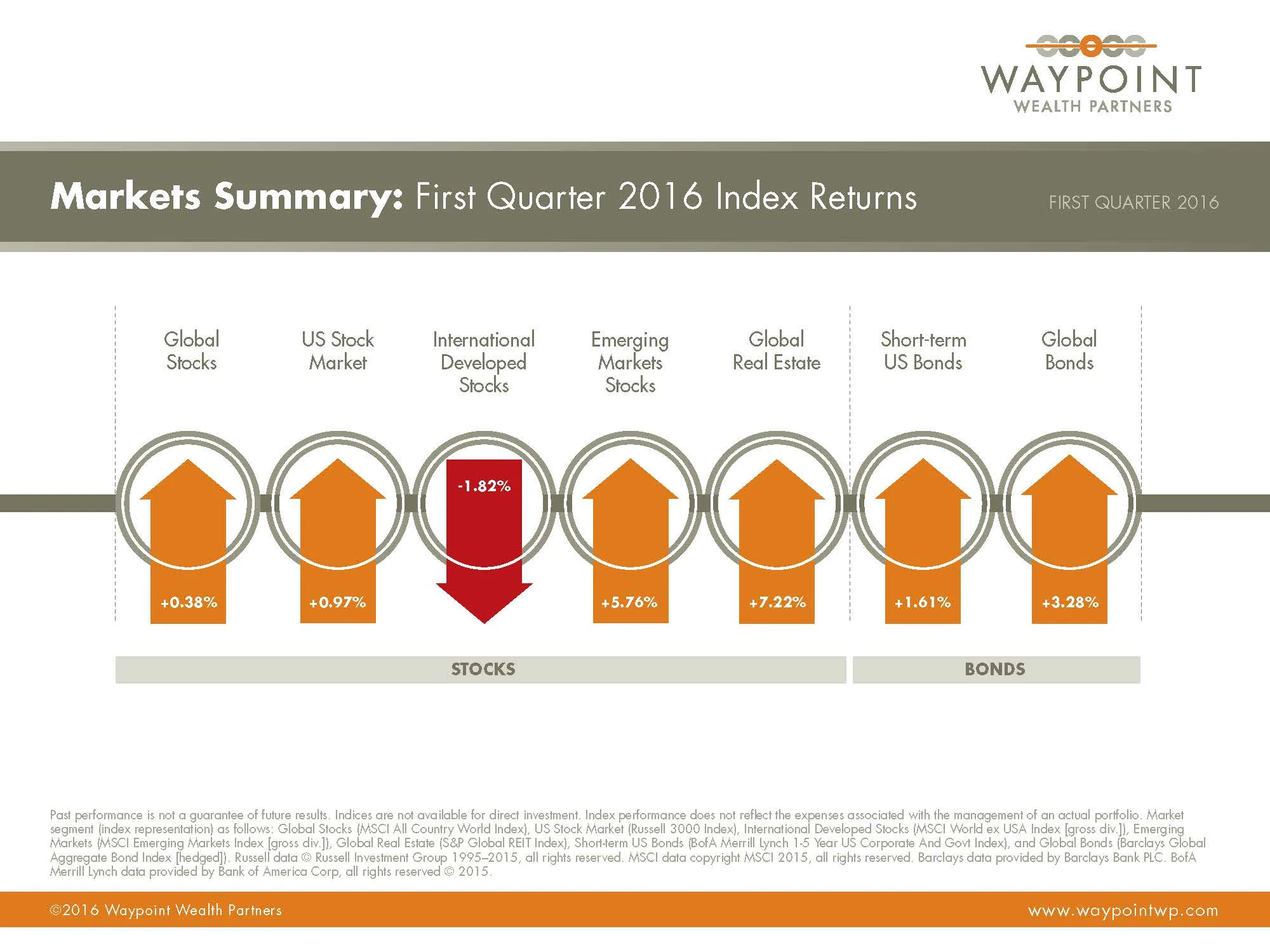

Just as interest rates in the US were finally inching upwards, bonds yields were met with strong headwinds in the form of global economic uncertainty. While many questions dissipated as the quarter progressed, caution around the world still dominated market sentiment. The demand for safety drove prices higher and bond yields lower for the quarter, resulting in net positive returns for high quality fixed income. European and Japanese central banks supported prices by pushing yields on short term government bonds so low they dipped below zero. This means investors were actually paying for the privilege of investing in short-term government bonds. Global bonds delivered a solid return of 3.28% for the quarter. Here in the US, short-term bonds earned 1.61% while the broad US bond market was up 3.03%.

STOCKS

The first quarter was a stark reminder that stocks can be very volatile over short periods of time. It was as if a year’s worth of action was condensed into the first three months. A chart of equity prices for the period looks like a “V.” At its lowest point, the S&P 500 was down over 10% from its previous high. Fortunately, equity markets didn’t linger at those low prices for long. The US stock market ended the quarter essentially flat, earning just under 1%. International developed stocks lagged both US and emerging markets and were the only major equity asset class to finish in negative territory with a loss of 1.82%. A weaker US Dollar helped emerging markets outperform developed markets, including the US, with a return of 5.76%. Real estate investment trusts (REITs) were the top performers, specifically International REITs, returning more than 7%.

ECONOMY

The quarter began with many questioning whether or not we were approaching a global down-turn. There was indeed weak economic data, uncertainty about the impact of plunging oil prices and a fear that the US Federal Reserve increased interest rates too soon. Additionally, the pace and severity of China’s slowdown was also a concern and the US consumer retrenched a bit in January. However, there was plenty of data to support a belief in continued economic growth as well. In mid-February, central bankers released statements citing their commitment to supportive policies and underscored the continued economic improvement. The US job market produced solid results and wage increases gained much needed momentum, which has been an absent trend. Key measurements of the service economy also produced favorable results. Due to the additional uncertainty generated in the quarter, the Fed is now forecasting they will increase interest rates at a slower pace than initially planned while the European Central Bank announced it will be even more aggressive implementing its monetary policy. Overall, inflation is low and economic growth around the world remains positive but there is plenty of room for improvement.

Seven Ways to Fool Yourself

The philosopher Ludwig Wittgenstein once said that nothing is as difficult for people as not deceiving themselves.

But while most self-delusions are relatively costless, those relating to investment can come with a hefty price tag. We delude ourselves for a number of reasons, but one of the principal causes is a need to protect our own egos. So we look for external evidence that supports the myths we hold about ourselves, and we dismiss those facts that are incompatible.

Psychologists call this “confirmation bias”—a tendency to select facts that suit our own internal beliefs. A related ingrained tendency, known as “hindsight bias,” involves seeing everything as obvious and predictable after the fact. These biases, or ways of protecting our egos from reality, are evident among many investors every day and are often encouraged by the media.

Here are five common manifestations of how investors fool themselves:

“Everyone could see that market crash coming.” Have you noticed how people become experts after the fact? But if “everyone” could see a correction coming, why wasn’t “everyone” profiting from it? You don’t need forecasts.

“I only invest in ‘blue-chip’ companies.” People often gravitate to the familiar and to stocks they see as solid. But a company’s profile and whether or not it is a good investment are not necessarily correlated. Better to diversify.

“I’m waiting for more certainty.” The emotions triggered by volatility are understandable, but acting on those emotions can be counterproductive. Uncertainty goes with investing. Historically, longterm discipline has been rewarded.

"I know about this industry, so I’m going to buy the stock.” People often assume that success in investment requires a specialist’s knowledge of a sector. But that information is usually already in the price. Trust the market instead.

"I’m going to restrict my portfolio to the strongest economies.” If an economy performs strongly, that will no doubt be reflected in stock prices. What moves prices is news. And news relates to the unexpected. So work with the market.

This is by no means an exhaustive list. In fact, the capacity for human beings to delude themselves in the world of investment is never-ending. But overcoming self-deception is not impossible. It just starts with recognizing that, as humans, we are not wired for disciplined investing.

We will always find one way or another of rationalizing an emotional reaction to market events. But that’s why even experienced investors engage advisors who know them, and who understand their circumstances, risk appetites, and long-term goals. The role of that advisor is to listen to and acknowledge our very human fears, while keeping us inline with the plans we committed to when we were our most lucid and logical.

We will always try to fool ourselves. But to quote a piece of folk wisdom, the essence of self-discipline is to do the important thing rather than the urgent thing.