ECONOMY

Inflation moderated through year-end, as did the magnitude of interest rate hikes. Fed Funds’ target range now stands at 4.25-4.5%. The FOMC’s hawkish tone and expected peak range still remain slightly at odds with market participants, with the market expecting a lower peak and relatively quick shift to rate cuts to stave off weakness in overall economic growth. Some SF Fed projections show the “effective” Fed Funds rate over 6% currently when trying to estimate the impact of the Fed’s balance sheet runoff in interest rate terms of economic tightening in conjunction with the Fed Funds rate hikes. Other major central banks began slowing the pace of rate hikes, or even pausing, to the let the impacts play out and try to balance the risk of over tightening. Though moderating, inflation remains elevated across most of the globe, China being the exception. This year, inflation and interest rate levels remain a key focus, yet there are bound to be unexpected risks that will shift the narrative.

Here in the US, while housing prices first pointed toward recession when activity and pricing were hit by rising mortgage rates and therefore affordability, the next question became when the labor market would roll over, too. Through year-end, the labor market remained resilient, albeit slowing from very strong post-pandemic job growth, and wage inflation was moderating as well. This and the relatively positive position of consumers and businesses could help the recovery start sooner if we enter a local, or even global, recession, rather than experiencing a deep and drawn-out event. Manufacturing activity contracted significantly toward year-end. Its trough is closely correlated with the beginning of a new expansionary cycle for US stocks, though we caution against the value of any one economic measure and against market timing.

Economic and geopolitical uncertainty led to high volatility and losses for the year in most asset classes across global capital markets. We expect equity volatility to remain elevated, but fixed income volatility to come back down as we get closer the end of the current rate-hiking cycle.

STOCKS

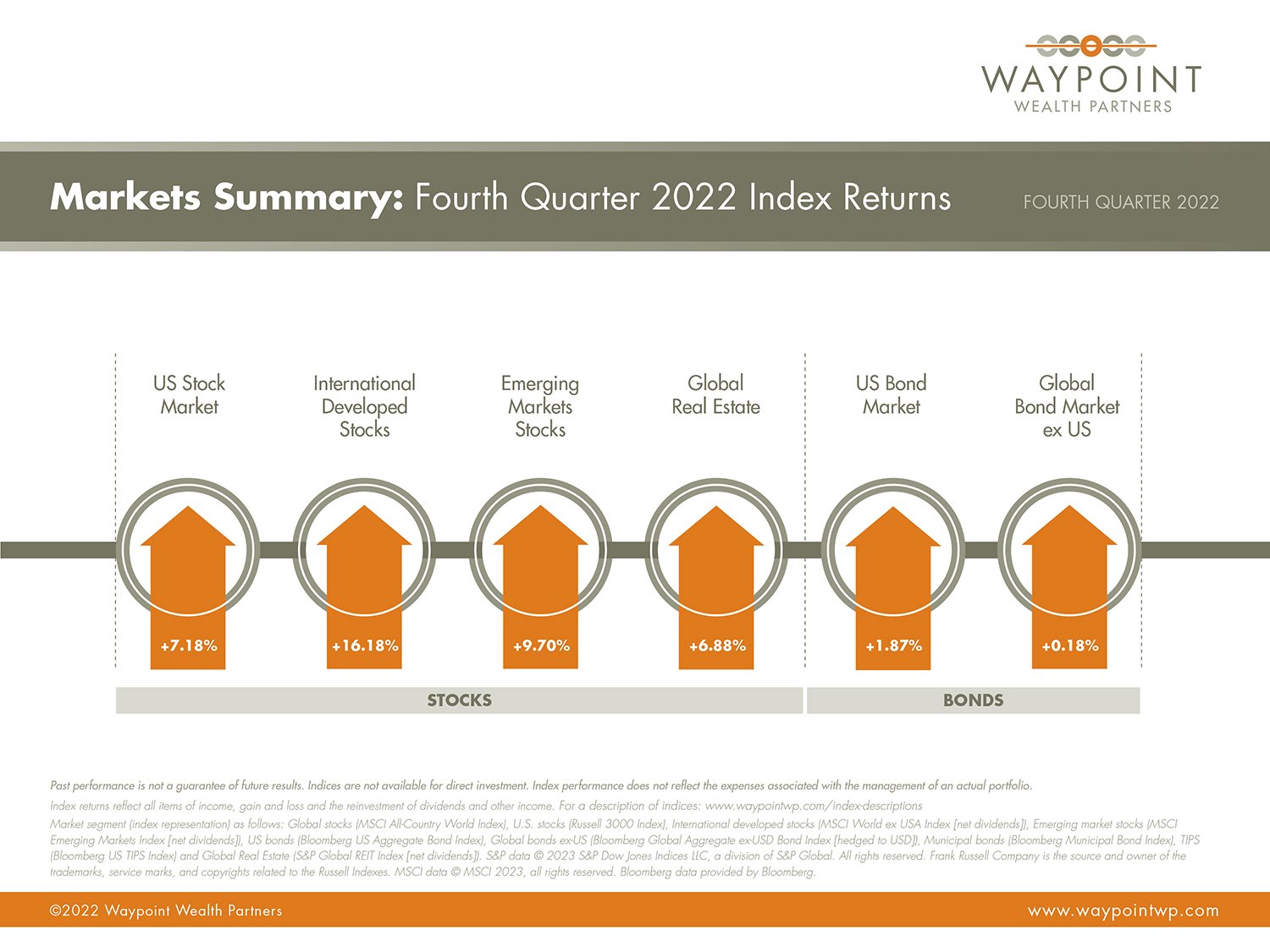

Global stocks were up 9.88% during Q4. The US Dollar index fell rapidly in last few months, but due to previous record strength, it still ended the year up 8.4%. Given this, the performance of local currency foreign stocks was even better before being exchanged into USD terms for US based investors.

After posting gains in the three previous years, the S&P 500 turned sharply negative in 2022, producing its worst annual result since 2008. For the year, the index finished down 18.1% on a total return basis; the Dow’s setback was comparatively modest at 6.9% while the NASDAQ lagged with a 32.5% decline.

The past year produced a huge performance gap between the value and growth equity styles across the globe, continuing a swift reversal after a strong run for growth in recent years, with artificially low rates and cost of capital. For example, a US large-cap value index (Russell 1000 Value) fell nearly 8% on a total return basis while its growth-style counterpart dropped 29% (Russell 1000 Growth).

International developed stocks outperformed US stocks, gaining 16.18% for the quarter. Emerging markets stocks also outperformed US stocks for the quarter, up 9.7%. While a quarter is way too short of a timeframe to judge, this is also a welcomed shift, and why patience is essential to successful long-term investing.

With the shift in inflation and interest rates, multiples on stocks’ earnings have generally been reduced, leading to price pressures. It’s possible that we have a negative 2023 in terms of growth in corporate profits, which could put upward pressure on multiples. As always, there is a very wide range of potential stock return scenarios going into the new calendar year. Bonds, however, are a bit clearer picture.

BONDS

The year was an especially difficult one for bond investors, as a US investment-grade fixed-income benchmark, the Bloomberg US Aggregate Bond Index, finished down 13%, by far the worst calendar year on record back to the great depression. As for government bonds, the yield of the 10-year US Treasury bond finished 2022 around 3.88%, up from 1.51% at the end of 2021, and the yield curve remains inverted (higher shorter than long-term rates) at levels rarely seen, often a predictor of a recession ahead.

US bonds were up 1.87% for the quarter. Global bonds ex-US were slightly positive, up 0.18%.

Bond math is much more straightforward than stocks due to the certainty of the cash flows and timing. The starting yield is a solid estimate of the return you can expect over the lifetime of a bond. That’s why so many bond portfolio managers are more excited for the future return opportunities than they have been in several years. Investor flows, however, show the largest outflows on record for bond funds. Not a good way to buy low and sell high. For example, if you bought the US aggregate bond index ending 2021 at a 2% yield with a 6 duration, you’d expect to earn about 2% per year over 6 years, or about 12% cumulative. If you were down 13% in year 1 (2022), you would now have 5 years left to get 25% return, or about 5%/year average expected return going forward. As long as your investment horizon is longer than the duration of the bond portfolio, you should be very excited about earning returns in bonds again. This means stocks have to do less of the heavy lifting to get us attractive overall results.

REAL ESTATE

Global real estate was up 6.88% for the quarter, underperforming broad global stocks but handily beating bonds. US real estate investment trusts (REITs) underperformed non-US REITs during the quarter, and in aggregate REITs were hit hard for the year. We slightly reduced our target portfolio exposure early in 2022. With high sensitivity to interest rates and the economic cycle, it could become more attractive as we head into the recovery phase. Given its relatively small size in the global equity index, we remain about neutral to global public real estate overall.

——

Market segment (index representation) as follows: Global stocks (MSCI All-Country World Index), US stocks (Russell 3000 Index), International developed stocks (MSCI World ex USA Index [net dividends]), Emerging market stocks (MSCI Emerging Markets Index [net dividends]), US bonds (Bloomberg US Aggregate Bond Index), Global bonds ex-US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]), Municipal bonds (Bloomberg Municipal Bond Index), TIPS (Bloomberg US TIPS Index), US REITs (Dow Jones US Select REIT Index), Non-US REITs (S&P Global ex-US REIT Index) and Global Real Estate (S&P Global REIT Index [net dividends]). S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2023, all rights reserved. Bloomberg data provided by Bloomberg.

Quarterly Article: Time the Market at Your Peril

By David Booth, Executive Chairman and Founder, Dimensional Fund Advisors

Technology enables immediate access to everything wherever and whenever we want it. In many cases, such as staying in touch with friends and family, or learning about world events, that’s a good thing. However, when it comes to investing and money management, my fear is that faster and easier ways of investing will allow people to lose more money faster and easier.

As access to investing expands, it becomes even more important to adopt an investment plan that doesn’t try to actively pick stocks or time the market. The purpose of having an investment plan is so you can relax. So you don’t look at the market every day, stressing out and asking, “How’m I doing? How’m I doing?” Investors actively trading are not just potentially missing out on the expected return of the market—they’re stressed out, worrying about how the news alert they just received will impact their long-term financial health, and whether they can or should do anything about it.

I don’t blame people for this. The financial services industry has not done a good enough job educating investors that the best approach for their long-term financial well-being is to make a plan, implement it, and stick with it.

But it has done a great job selling index funds. Over the past decade, the percentage of the stock market that is passively held has grown considerably, with equity index funds representing 52% of the US equity fund market at the end of 2021.1

And yet some investors appear to be using index funds to pursue an active investment approach. For example, the largest S&P 500 ETF had the highest average daily trade volume of US-listed securities in 2021, at $31 billion.2 So instead of picking individual stocks, people seem to be acting like stock pickers when buying and selling index funds and ETFs.

Despite the overwhelming evidence and compelling story to the contrary. When economist Michael Jensen published his landmark 1968 paper, which showed that active stock pickers added no consistent value, other academics soon confirmed his insights. More than five decades and 50 years of data later, the theory still holds up. There are some stock pickers who experience success, but we don’t know how to identify them before the fact. We can’t separate skill from luck. Picking stocks is more like gambling than investing.

This academic research inspired the invention of the index fund, which allowed investors not only to buy the broad stock market, but also to track the performance of the manager and compare costs. I worked on one of the first index funds. When I co-founded Dimensional, we built strategies that were informed by indices but weren’t limited by the same mechanical constraints. So I accepted this research early on and built a company based on it. I still believe it 50 years later. My colleagues and I weren’t sure at the beginning that it would appeal to a lot of people, but it did.

I’m proud of the fact that we have always viewed marketing as a way to educate financial professionals and investors. In fact, we started by working with institutions and only expanded to individual investors by working with financial advisors who could help teach their clients how to think about the market and invest for the long term. We wanted to prevent people from making the mistake I still see too many people making.

But I fear it will only get worse. ETFs make it easier to trade. So do free platforms that allow people to trade on their phones. There seem to be as many ETFs as there are stocks that make up those ETFs. I really like ETFs. They are another chapter in this 50-year story of creating safer and better financial products for investors. Our firm has been using them to give financial professionals and investors more choice in how they access Dimensional Investing. But they are tools, and they have to be used effectively.

Which is why you may need an advisor more than ever—to help keep you from jumping from one thing to another. Our approach is to get you out of the game of worrying and guessing by having a plan that can provide peace of mind. It’s a sensible approach you can live with. Trust the financial advisor who trusts the market.

The financial industry has made great strides improving the investment options available, but we have more work to do helping investors with those options. There are great solutions right in front of people. As an industry, we need to do a better job of educating current and potential clients. How the bulk of our society lives out their later years depends on it.

——

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein. This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd. and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value • Dimensional Fund Advisors does not have any bank affiliates.

——