Markets Update: A Year in Review

Mitigation has become the central theme around investing, economics, and geopolitics in 2020. Governments have had to quickly come up with plans, both good and bad, to mitigate the spread and impact of SARS-Covid-2, businesses have had to innovate or shutter to comply with regulations, and everyone has had to come up with their own plans for how to go out into the world while mitigating their own potential risk of exposure. At this point, the economy has almost certainly entered a recession, something that occurs on average every 4 to 5 years. As a result, Global Central banks have quickly pivoted to injecting as much cash and liquidity into their banking systems as they can, legislators have worked on rushing through relief packets for businesses and people affected by the shutdowns. With all of this uncertainty, discipline around diversification and rebalancing remains very important in your portfolios.

BONDS

Investment grade fixed income had a good quarter with U.S. bonds returned 3.15% and global bonds earned 0.51%. The High Yield (AKA “Junk Bond”) market was challenged as the risk of default for these more speculative bond investments rose. As a philosophy, we avoid these types of bonds in your portfolio. Additionally, the municipal bond market experienced a large dislocation in pricing in the middle of March, due to the nature of these bonds being owned more so by individual investors than institutions. When individual investors panicked, they sold at prices that were much lower than fundamentals supported. For those of you who own municipal bonds, this gave rise to an opportunity for the managers we partner with to add these bonds at attractive prices.

STOCKS

Equity markets experienced the quickest drop from

bull to bear in history from mid-February to mid-March, while also having the quickest rise to a bull market from late-March to early-April (in purely technical terms).

We expect the stock markets to be whipsawed by the ever evolving news around the coronavirus. All stock indices were meaningfully negative for the quarter with U.S. stocks down 21% and international stocks and emerging markets stocks each seeing negative returns down roughly 23.5%. All together we see volatility continuing throughout 2020. That said we remind ourselves to expect the unexpected and not to rely on short term forecasts to drive your investment strategy.

ECONOMY

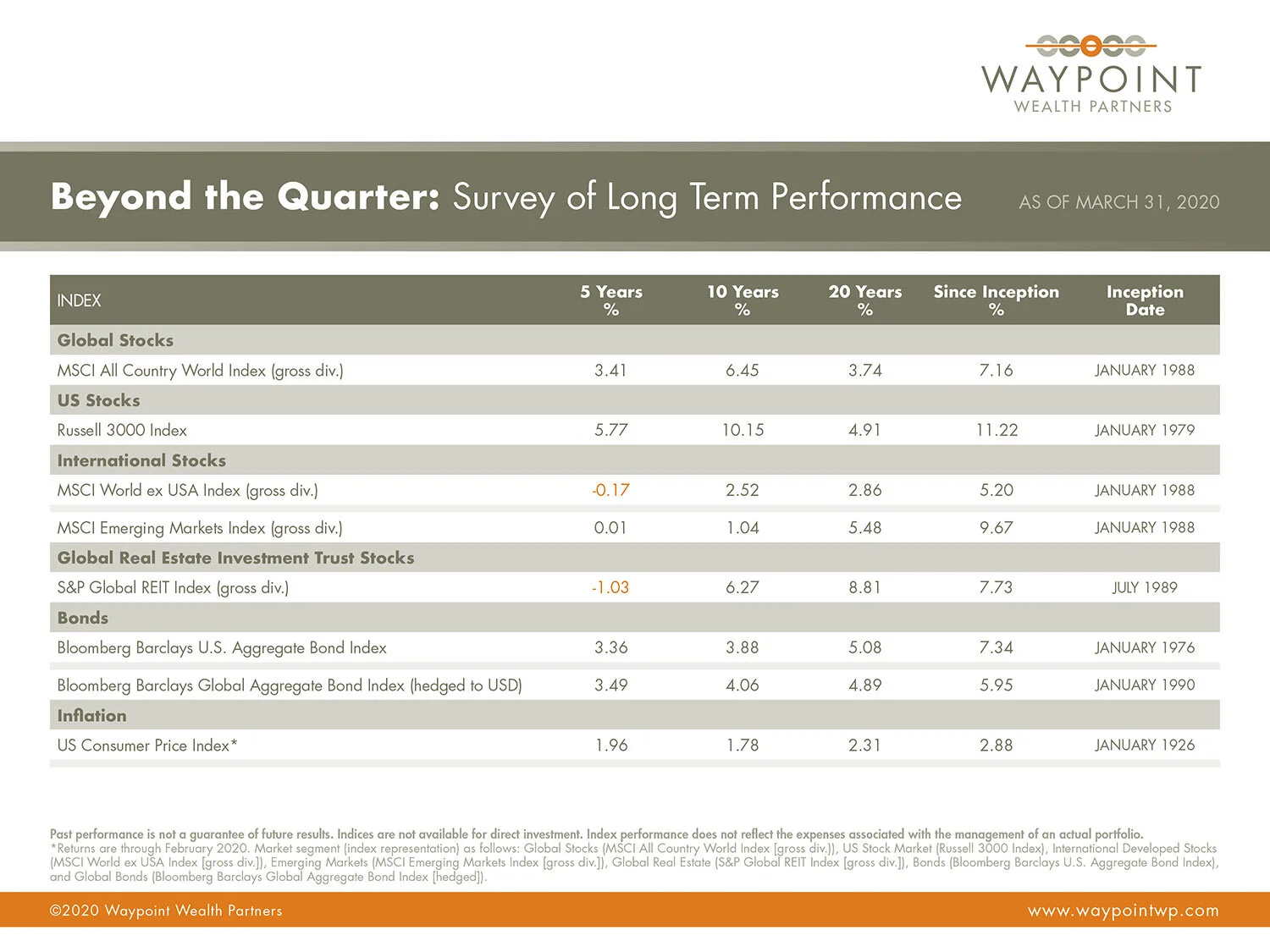

The global economy will almost certainly be classified as in recession. The economic indicators we follow all now signal as such. The labor market experienced record setting applications for unemployment as businesses reduced hours or eliminated jobs. Corporations have acknowledged that they will see sharp declines in earnings in the 1st quarter and are not giving guidance on future earnings. In essence, the economy has been put on hold as we wait for the coronavirus pandemic to abate. This exogenous shock has artificially lowered both aggregate supply and aggregate demand. Once the pandemic is brought under control, we expect both supply and demand to come back meaningfully. Maybe not at pre-crisis levels right away, but appreciably as the economy warms back up. This suggests two things: 1) Resilience from a diversified portfolio across stocks, bonds, and geographies is even more important today. 2) Focusing on your long-term investment plan and rebalancing your portfolio will likely be rewarded with solid returns over the next few years.

—

—

Topic of the Quarter: The Coronavirus and Market Declines

We are in a challenging time, facing rapidly evolving information about the coronavirus and the effects on how we work and live. Markets continue to function and are reflecting this constant change, which means greater volatility. Those circumstances don’t make it easy for investors to stay in their seats. When markets are good,

a lot of energy naturally goes toward putting more money in. When markets are bad, the energy often focuses on taking money out.

We’ve been through tough times before. Just about everyone remembers the 2008–2009 global financial crisis, even if they weren’t old enough to be in the workforce at the time. More experienced investors may consider the tech boom and bust of the late 1990s and early 2000s as the bellwether event for a generation that assumed they could get rich on a handful of great stock picks. And for those of us who go farther back, it was once hard to envision anything tougher than the 1973–1974 bear market.

The recent decline has much the same feel as past crises, with fear, anxiety, and worry elevated in the moment. Times like these are never easy

for investors, who must grapple with the feeling

that “things just might be different this time.”

Scrolling through the news, it’s understandable to think the volatility is worse and longer lasting than anything before.

So how can we help minimize the fear and anxiety that you are feeling? As we all know, it’s not easy to address these concerns with a few simple words or just one conversation. For most of our clients, the key to minimizing fear and anxiety is a regular cadence of communication and interaction that helps get to a place where they truly feel they “will be okay.” If you have not been receiving our emails over the last month, please let us know, or find them on our website at www.waypointwp.com under the Insights header. Otherwise, please do not hesitate to reach out to us if you are not feeling “okay.” We are here to help provide perspective on both the short-term and the long-term.

Finally, remember that risk or volatility is part of investing. It’s why we as investors can demand higher returns for riskier investments. Furthermore, when risk rises, our demand for higher returns on those same assets increases. This is simply the flipside of the same coin that reflects lower prices when risk rises. The important thing is to remain disciplined, don’t try to time the markets, and focus on keeping healthy through this crisis.

—