"When your values are clear to you, making decisions becomes easier." — Roy E. Disney

Taking the first step …

Archived - A Quarter in Review: Second Quarter 2016

Both risky and safe-haven assets alike were on track to finish the quarter comfortably in positive territory until June 23rd when a majority of UK citizens voted to leave the European Union (EU). The so called Brexit rocked financial markets around the world. As a result, stock markets finished the quarter with marginally positive returns and in highly unstable fashion. The global economy continued on a sluggish path, which prompted further caution by central bankers and supported high quality fixed income assets.

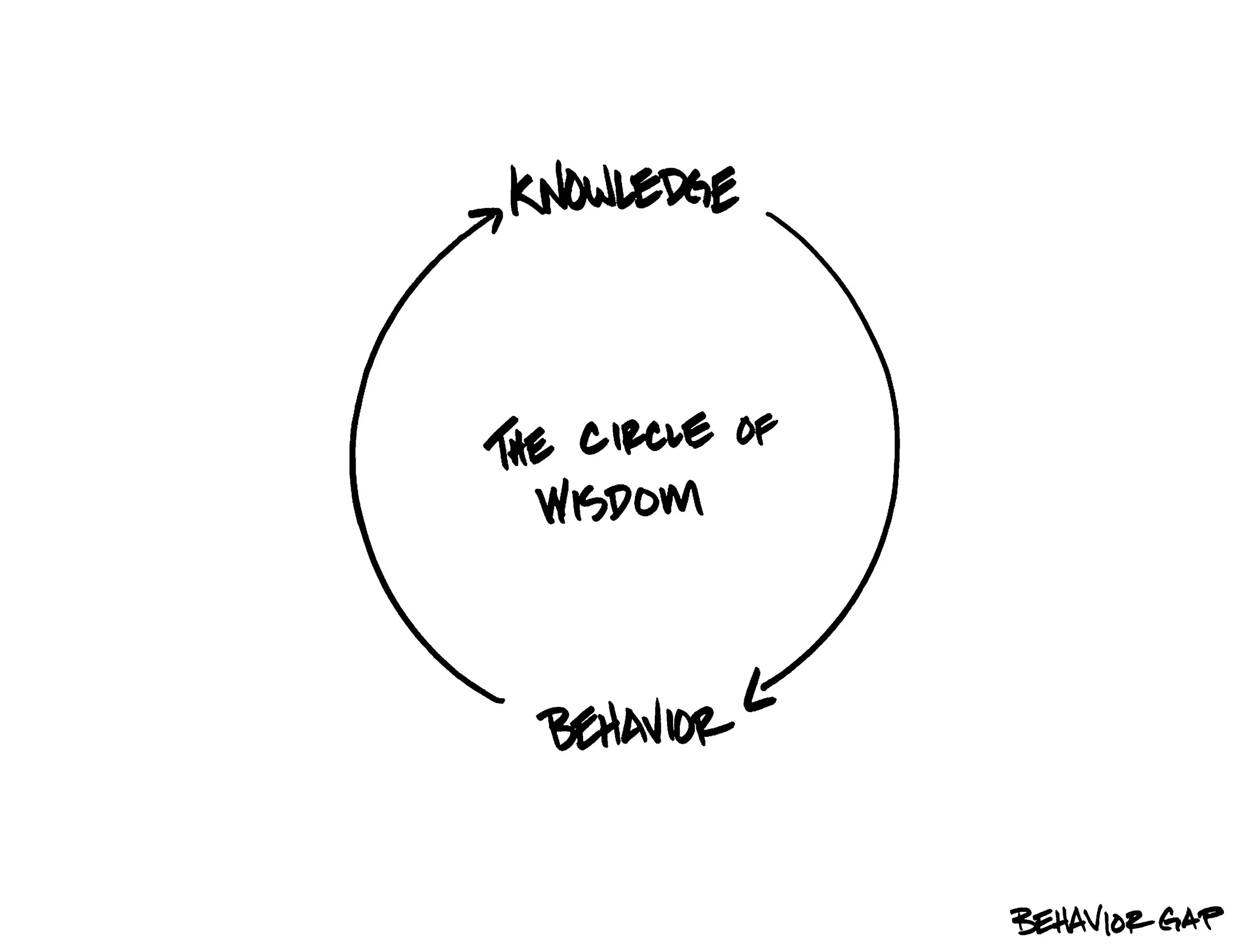

Circle of Wisdom

Flat world

”It all happened while we were sleeping, or rather while we were focused on 9/11, the dot-com bust and Enron — which even prompted some to wonder whether globalization was over. Actually, just the opposite was true, which is why it’s time to wake up and prepare ourselves for this flat world, because others already are, and there is no time to waste.” — Thomas Friedman, New York Times, April 2005

Archived - Babies being born, happy couples getting engaged … all good

Information dump

Archived - Why Diversify?

Equity markets experienced a sharp decline to start 2016, causing some investors and analysts to re-evaluate their core investment principles. One common question being asked is whether or not there is a still a need for global diversification, which is not a surprising one given the investment returns so far this decade.

The Times, They are A'Changin'

Bob Dylan’s classic anthem, “The Times They Are A-Changin’,” released in 1964 seems as applicable today as it was 50-plus years ago. But the pace of change has been amplified. A 2015 report by McKinsey & Co. stated, “The pace of change is happening at 10x the speed of the first industrial revolution and the power is 300 times, which equals 3,000 times the impact of the second industrial revolution than the first one.” I think many people would agree.

Archived - Markets Update: First Quarter 2016

If you are just now looking at market returns for the first quarter you would be forgiven for thinking that the markets experienced a relatively boring three months. Developed markets finished flat, emerging markets were finally positive, real estate bounced back from a weak 2015 and bond returns were in the low single digits. However, a lot can happen in three months and what actually transpired was far from dull. January delivered one of the worst starts to a year the S&P 500 index has ever experienced, global recession concerns spiked, oil prices fluctuated wildly and the Chinese economy continued to produce mixed signals. Selling pressure continued through the first week of February

before cooler heads prevailed and the second half of the quarter topped off a whirlwind of action with a significant recovery.

Archived - WWP team reading, puzzling, learning, laughing, traveling

Archived - Markets Update: 2015 Year in Review

2015 provided another example of how dynamic and rapidly changing our world is. Significant events included the highest job growth since 1999, two downgrades to the global economy, the Federal Reserve raising interest rates for the first time since 2006, Russia getting directly involved in the Syrian conflict, which pushed the immigrant crisis to levels not seen since WWII, and a dramatic rise and fall of the Chinese stock market. Despite all these events, 2015 provided quite unremarkable investment returns. US markets were slightly up, European markets slightly down, global real estate and global bonds slightly up and emerging markets down double digits. Volatility is back as markets try to digest the impact of these events and we expect that to continue through 2016.

Repeat

I want to slow down … but how?

Archived - Markets Update: Third Quarter 2015

Simply stated, the third quarter was quite volatile, especially for global equity markets. Equity indices were driven down significantly by concern about China and other emerging market economies while bonds and REITs managed to provide flat to slightly positive returns. As regular readers of this report know, it was only a matter of time before stocks experienced some form of a pullback given the run up in US markets and the various headwinds around the world.

Too busy?

The Big Mistake

Archived - Markets Update: Second Quarter 2015

In unfamiliar fashion, bonds ended the quarter in negative territory while stocks posted very modest gains. The period came to a close on a sour note with the dramatic re-escalation of the Greek crisis. In addition to the uncertainty surrounding Greece and the European Union (EU), a slowing China and the impending rate hike here in the US also made headlines. If history serves as any guide, these events should continue to be with us for the foreseeable future.